LendingTree offers a consolidation loan for those with a lot of unsecured debt. Be aware that there are important points to consider before you apply. The minimum credit score required for eligibility is 640. Also, your debt-to-income ratio cannot exceed 50% of your monthly income. A minimum of $20,000 must be in unsecured debt. LendingTree demands that you have been working for at minimum two years and have never filed bankruptcy.

Applying for a loan through LendingTree

The application process for a debt consolidation loan is very simple and approvals can often be made within the same day. Direct deposit is used to provide loan funds that you can use to pay your debts. But, applying for a loan through a consolidation company is not a guarantee of approval.

You will be able to lower your monthly payments and save money long term by applying for a consolidation loan. While it won't reduce the total amount of debt, it will simplify your financial situation and remove the confusion caused by numerous creditors. A lower interest rate will also be available, which could help your credit score over the long-term.

Cost of a loan

You should understand the costs involved in a consolidation loan. Your monthly payment will be increased by the interest rate and origination fee. They vary depending on which lender you choose. These fees typically range from 1% up to 8% of the loan amount. A loan of $5,000 could cost you $400 in the beginning.

The APR will show the interest rate, fees and other charges associated with your loan. You should keep in mind, however, that APRs for different lenders might vary by state. You should also remember that missed payments can damage your credit score. However, by consolidating your debt into a single loan, you'll make it easier to track your monthly payments and track your progress.

Criteria for loan approval

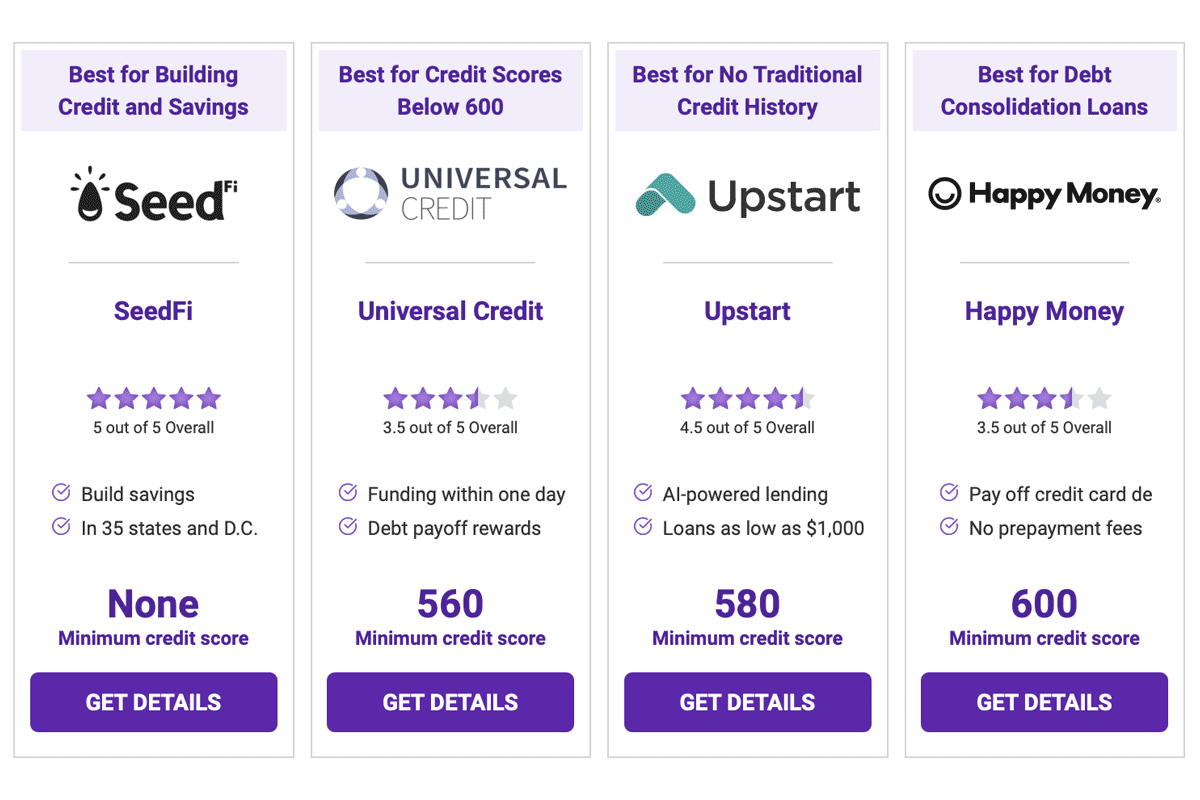

LendingTree has become one of the biggest online marketplaces offering personal loans and financial products. It has been operational for more than 26 year and has matched lenders with borrowers to fund almost $260 Billion in loans. Even though the interest rates are high, this can be an option for people with less than perfect credit.

You should be aware that your credit score could impact your loan approval. The results can be filtered by your creditworthiness and debt-to-income ratio. It is also recommended to be fully employed and have a substantial savings account. You can still be approved for a loan even if your credit score falls below the required threshold.

Rates of loan

It is important to take into account your credit rating when searching for a loan. LendingTree allows you to compare rates and fees from multiple lenders. In most cases, you can get up to five quotes. Some lenders offer phone support, fast funding and no upfront fees. You should also remember that lenders will perform a credit check. To ensure that you will receive the best possible interest rate, you should enter all of your relevant information truthfully.

LendingTree offers a wide variety of financial products and is one of America's largest online lenders. It has been in business for over two decades and has a solid reputation connecting lenders with borrowers. There are many options for personal loans as well as business loans and mortgages.

How to get a loan

If you have multiple debts, a debt consolidation loan may be the best solution for you. The process is quick and easy. You can get the funds that you need in a few short days. These funds are typically provided by direct deposit. The money can be used to pay your bills. A loan to consolidate your debt is a great way to improve credit scores.

Consider comparing multiple offers from different lenders when choosing a consolidation loan to consolidate your debt. Comparing multiple offers is a great way to save money and get a lower interest.

FAQ

How much debt is too much?

It is essential to remember that money is not unlimited. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. When you run out of money, reduce your spending.

But how much can you afford? While there is no one right answer, the general rule of thumb is to live within 10% your income. That way, you won't go broke even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. Spend no more than $5,000 a month if you have $50,000.

It's important to pay off any debts as soon and as quickly as you can. This applies to student loans, credit card bills, and car payments. Once those are paid off, you'll have extra money left over to save.

You should consider where you plan to put your excess income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. But if you choose to put it into a savings account, you can expect interest to compound over time.

Let's suppose, for instance, that you put aside $100 every week to save. This would add up over five years to $500. In six years you'd have $1000 saved. In eight years you would have almost $3,000 saved in the bank. You'd have close to $13,000 saved by the time you hit ten years.

Your savings account will be nearly $40,000 by the end 15 years. That's pretty impressive. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 in savings, you would have more than 57,000.

It is important to know how to manage your money effectively. Otherwise, you might wind up with far more money than you planned.

What is the fastest way to make money on a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You need to be able to make yourself an authority in any niche you choose. This means that you need to build a reputation both online and offline.

The best way to build a reputation is to help others solve problems. So you need to ask yourself how you can contribute value to the community.

Once you answer that question you'll be able instantly to pinpoint the areas you're most suitable to address. There are many online ways to make money, but they are often very competitive.

However, if you look closely you'll see two major side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has pros and cons. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. These gigs can be very competitive.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it takes time to become an expert on your subject.

To be successful in either field, you must know how to identify the right customers. This can take some trial and error. But in the long run, it pays off big time.

What is personal finances?

Personal finance is the art of managing your own finances to help you achieve your financial goals. It involves understanding where your money goes, knowing what you can afford, and balancing your needs against your wants.

If you master these skills, you can be financially independent. This means you are no longer dependent on anyone to take care of you. You can forget about worrying about rent, utilities, or any other monthly bills.

Learning how to manage your finances will not only help you succeed, but it will also make your life easier. It makes you happier. You will feel happier about your finances and be more satisfied with your life.

So who cares about personal finance? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends reports that the number of searches for "personal financial" has increased by 1,600% since 2004.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. You can find blogs about investing here, as well as videos and podcasts about personal finance.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. That leaves only two hours a day to do everything else that matters.

Financial management will allow you to make the most of your financial knowledge.

How does a rich person make passive income?

There are two main ways to make money online. The first is to create great products or services that people love and will pay for. This is called "earning” money.

The second way is to find a way to provide value to others without spending time creating products. This is known as "passive income".

Let's imagine you own an App Company. Your job is developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. This is a great business model as you no longer depend on paying customers. Instead, you rely on advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is the way that most internet entrepreneurs are able to make a living. Instead of making things, they focus on creating value for others.

What are the most profitable side hustles in 2022?

The best way today to make money is to create value in the lives of others. You will make money if you do this well.

Even though you may not realise it right now, you have been creating value since the beginning. Your mommy gave you life when you were a baby. Learning to walk gave you a better life.

You will always make more if your efforts are to be a positive influence on those around you. You'll actually get more if you give more.

Value creation is a powerful force that everyone uses every day without even knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In fact, there are nearly 7 billion people on Earth right now. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if your hourly value is $1, you could create $7 million annually.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. This is a lot more than what you earn working full-time.

Let's imagine you wanted to make that number double. Let's assume you discovered 20 ways to make $200 more per month for someone. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

Every day, there are millions upon millions of opportunities to create wealth. This includes selling information, products and services.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. Helping others to achieve their goals is the ultimate goal.

If you want to get ahead, then focus on creating value. You can start by using my free guide: How To Create Value And Get Paid For It.

What is the distinction between passive income, and active income.

Passive income means that you can make money with little effort. Active income requires effort and hard work.

You create value for another person and earn active income. When you earn money because you provide a service or product that someone wants. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income allows you to be more productive while making money. Most people aren’t keen to work for themselves. Instead, they decide to focus their energy and time on passive income.

Passive income doesn't last forever, which is the problem. You might run out of money if you don't generate passive income in the right time.

Also, you could burn out if passive income is not generated in a timely manner. It's better to get started now than later. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types or passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

Passive Income Ideas To Improve Cash Flow

It is possible to make money online with no hard work. Instead, there are passive income options that you can use from home.

Automation could also be beneficial for an existing business. If you are considering starting your own business, automating parts can help you save money and increase productivity.

The more automated your company becomes, the more efficient you will see it become. This allows you to spend more time growing your business than managing it.

Outsourcing tasks is an excellent way to automate them. Outsourcing allows you and your company to concentrate on what is most important. When you outsource a task, it is effectively delegating the responsibility to another person.

You can concentrate on the most important aspects of your business and let someone else handle the details. Outsourcing makes it easier to grow your business because you won't have to worry about taking care of the small stuff.

You can also turn your hobby into an income stream by starting a side business. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

Write articles, for example. You have many options for publishing your articles. These sites pay per article and allow you to make extra cash monthly.

Also, you can create videos. Many platforms enable you to upload videos directly onto YouTube or Vimeo. These videos can drive traffic to your website or social media pages.

Another way to make extra money is to invest your capital in shares and stocks. Stocks and shares are similar to real estate investments. You get dividends instead of rent.

As part of your payout, shares you have purchased are given to shareholders. The size of the dividend you receive will depend on how many stocks you purchase.

If your shares are sold later, you can reinvest any profits back into purchasing more shares. In this way, you will continue to get paid dividends over time.